So, you want to know how to opting in Composition Scheme for Financial Year 2020-21?

As you know there are two types of registered taxpayers under GST. One is regular and another is composition. If you want to opt-in composition scheme under GST for the financial year 2020-21 then this is the right time.

If you want to change from regular registered person to composition scheme then you are in the right place.

The application for opting-in composition scheme for the financial year 2020-21 has been made available on GST Portal.

However, if you are already a composition taxpayer then this option is not for you. There is no requirement to opt-in for the financial year 2020-21 if you were a composition taxpayer in the previous financial year.

In this article, I will describe how to opting in composition scheme under GST for Financial Year 2020-21. I will provide you ideas about some specific topics related to this matter.

Let’s start our discussion.

Contents

How to Opt for Composition Scheme?

There are two kinds of taxpayers who can opt for composition scheme. One is the new taxpayers and another is the existing taxpayers registered under regular scheme.

New Taxpayers

If you are a new taxpayer and want to register yourself as composition taxpayers then you can choose it at the time of registration.

You have to file GST REG-01 for GST registration.

Existing Taxpayers

If you are an existing taxpayer and want to change from regular to composition scheme, then you have to file GST-CMP-02.

Please remember the filing process must be done prior to the commencement of the next financial year.

So, you have to file GST-CMP-02 now if you want to change your registration type from the financial year 2020-21.

How to file GST-CMP-02 for opting-in composition scheme under GST for the financial year 2020-21?

You have to follow some simple steps to file GST-CMP-02.

And they are given below.

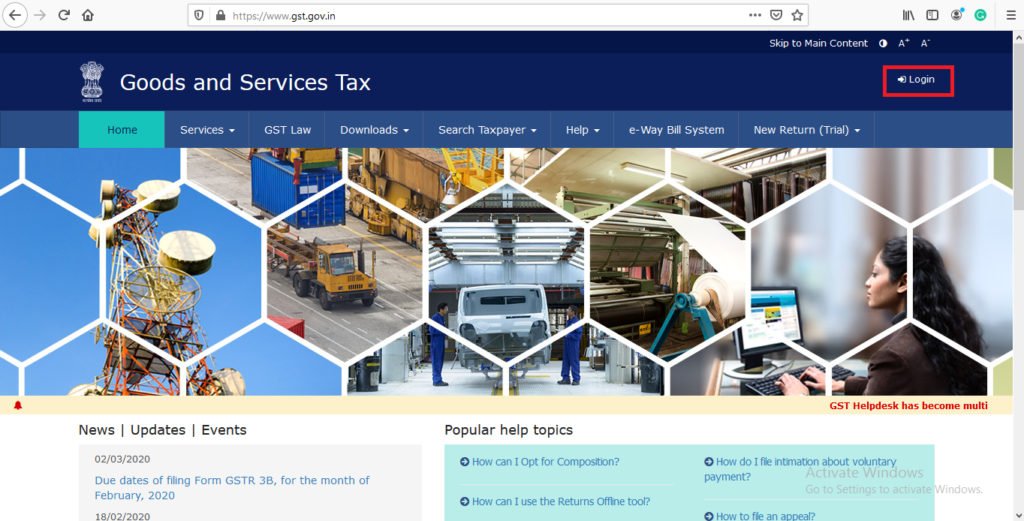

Step 1. Go to www.gst.gov.in. And click on the login button.

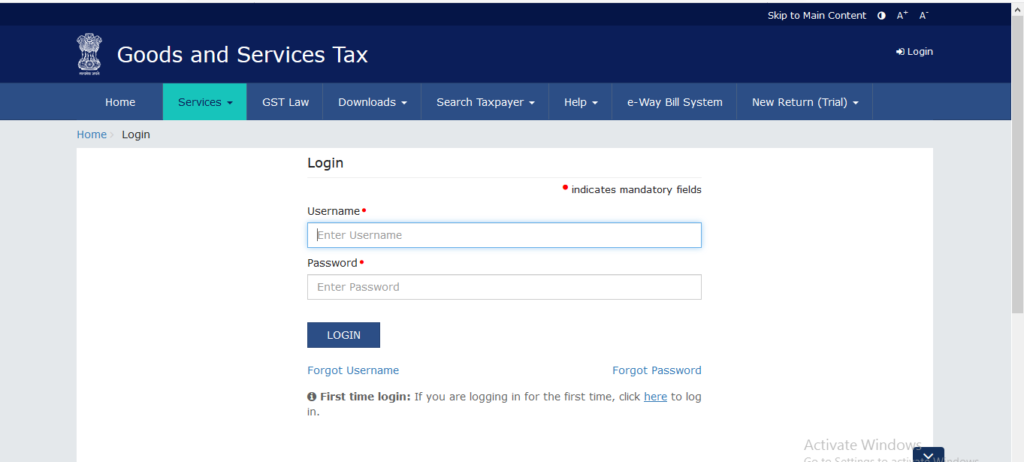

Step 2. Login to your GST portal after providing your user name and password.

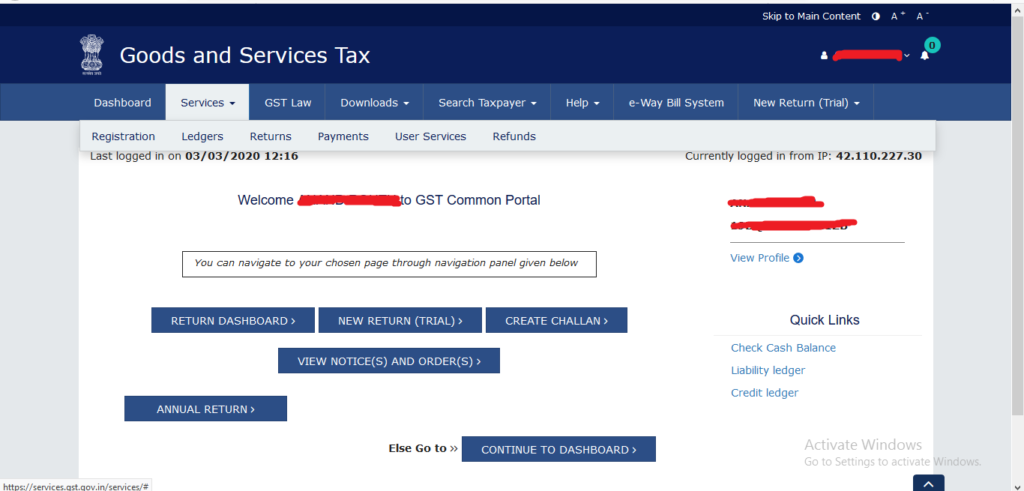

Step 3. After login, go to the “Service” tab and then go to the “Registration” menu.

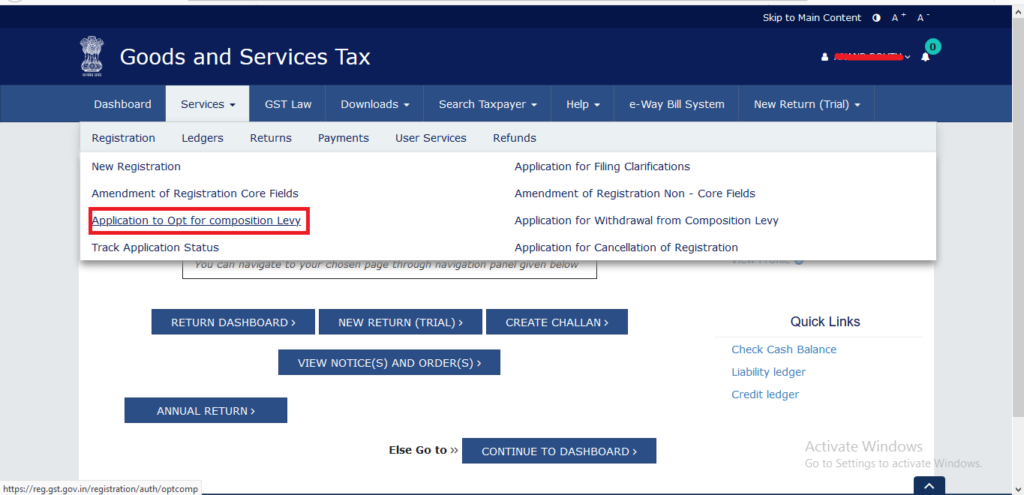

Step 4. Under the “Registration” menu you have to select “Application to Opt for Composition Levy“.

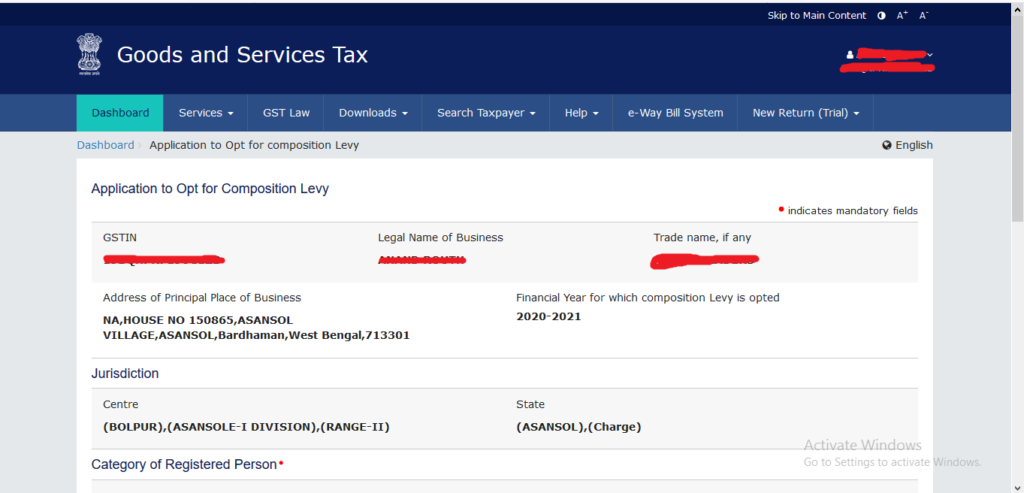

Step 5. A new page will open. You can see your nature of the business, jurisdiction, etc.

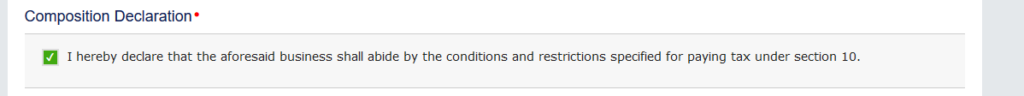

Step 6. You have to click the “Composition Declaration” as shown below.

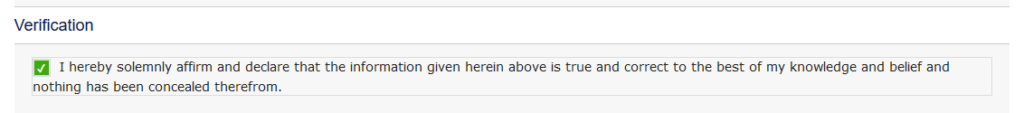

Step 7. Then you have to click on the “Verification” button.

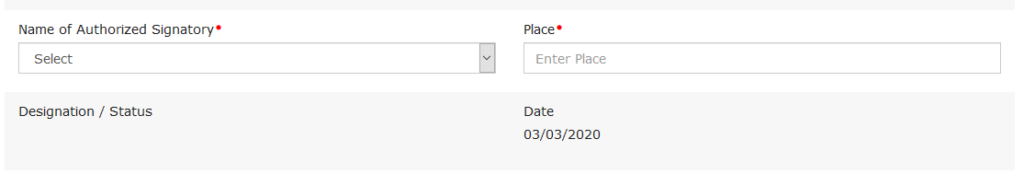

Step 8. You have to choose the “Authorised Signatory” from the dropdown box.

Step 9. You must have to provide the place. Then you can file the CMP-02 either by submit with DSC or submit with e-sign or submit with EVC.

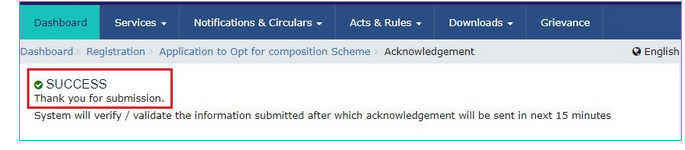

Step 10. After completion, you will receive the “Success” message.

Eligible Taxpayers for opting Composition Scheme

The following persons are eligible to opt-in composition scheme:

- The normal taxpayers having aggregate turnover (At PAN level) below Rs. 1.5 Cr in the previous financial year (Rs. 75 Lacs for some specified states), and

- The normal taxpayers supplying services and/or mixed supplies having aggregate turnover of last financial year below Rs. 50 lakhs.

Who are not eligible for opting Composition Scheme

The following taxpayers are not eligible for opting composition scheme:

- Suppliers of the goods/services who are not liable to be taxed under GST,

- Inter-State outward suppliers of goods/services,

- The taxpayers supplying through e-commerce operators, who are required to collect tax under section 52,

- The manufacturers of notified goods like (i) Ice cream and other edible ice, whether or not containing cocoa, (ii) Tobacco and manufactured tobacco substitutes and (iii) Pan Masala, (iv) Aerated water

- A Casual taxpayer,

- A Non-Resident Foreign Taxpayer,

- A person registered as Input Service Distributor (ISD),

- A person registered as TDS Deductor /Tax Collector.

The following points are very useful for you:

- The eligible registered taxpayers, who want to opt-in for composition scheme for the Financial Year 2020-2021, may file FORM GST CMP-02 application up to 31st March 2020 on the common portal.

- Once the CMP-02 application is filed, the composition scheme shall be available to the taxpayer w.e.f. 1st April 2020.

- If you are a regular taxpayer in the previous financial year but are opting-in composition scheme for 2020-21 should file ITC-03 for reversal of ITC credit on stocks of Inputs, semi-finished goods and finished goods available with you within a period as prescribed under Rule, 3(3A) of CGST Rules, 2017.

- Composition taxpayer needs to pay tax and furnish a statement, every quarter or part thereof, as the case may be, in FORM GST CMP-08.

- Further, you have to furnish a return for every financial year or part thereof, as the case may be, in FORM GSTR-4.

- Finally, you have to file the Annual Return in FORM GSTR-9A.

Final Word.

I hope the information mentioned above are useful to you.

In case of any doubt feel free to ask me.

Again, please share this article if you think it is informative. As you know sharing is caring.

Ok. Ta-Da.