So, you want to know the details about free of cost PAN card apply. And why not? It is a very big opportunity for everyone to apply PAN card free of cost. And, everybody wants to know the procedure.

Actually this PAN is known as e-PAN. It is a little different from the normal PAN card. Or, you can say it is not a physical PAN card.

To provide the PAN card free of cost, GOVT takes a very good step in the form of the “e-PAN” card.

You have to remember the following points:

- It is a paperless process.

- Very easy one.

- You have not required to submit or upload any documents.

- It holds the same value as the physical PAN card.

Ok. Let’s discuss the procedures.

Contents

What is e-PAN?

PAN or Permanent Account Number is a 10 digit alphanumeric unique number. It is issued by the Income Tax department.

On the other hand, e-PAN is based on AADHAR. It is issued on the basis of AADHAR based instant PAN allotment service.

You must know that this e-PAN is a valid one and it is not different from the physical PAN issued by the department. It is digitally signed and therefore known as e-PAN.

Is e-PAN valid?

According to Notification number 7 of 2018, dated 27/12/2018, the PAN issued electronically in PDF format i.e. e-PAN is a valid one.

It contains QR code having demographic details (such as name, DOB and photo) including biometric information.

You can use a QR code reader.

Guidelines

Following points, you must remember before applying a pan card free of cost.

- You must have a valid AADHAR number.

- That AADHAR number is not linked with any other PAN.

- You must have a mobile number registered with AADHAR.

So, it is very clear that if you want to apply PAN card free of cost you must have a valid AADHAR number.

How to apply PAN card free of cost?

You must have to follow the following steps:

1. Visit e-filling website of income tax department i.e. incometaxindiaefiling.gov.in.

2. Click- “Instant PAN through Aadhar”.

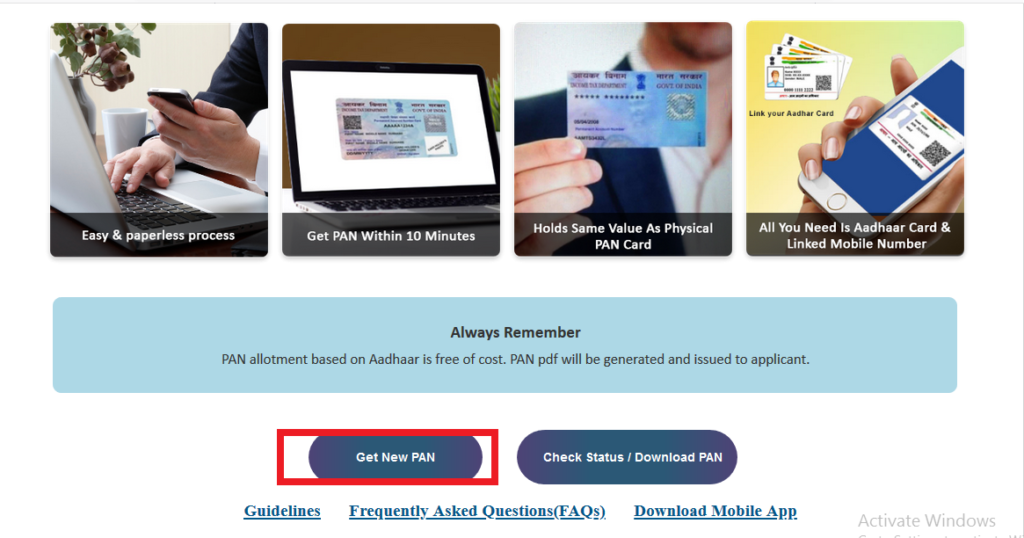

3. Then click on “Get New PAN”.

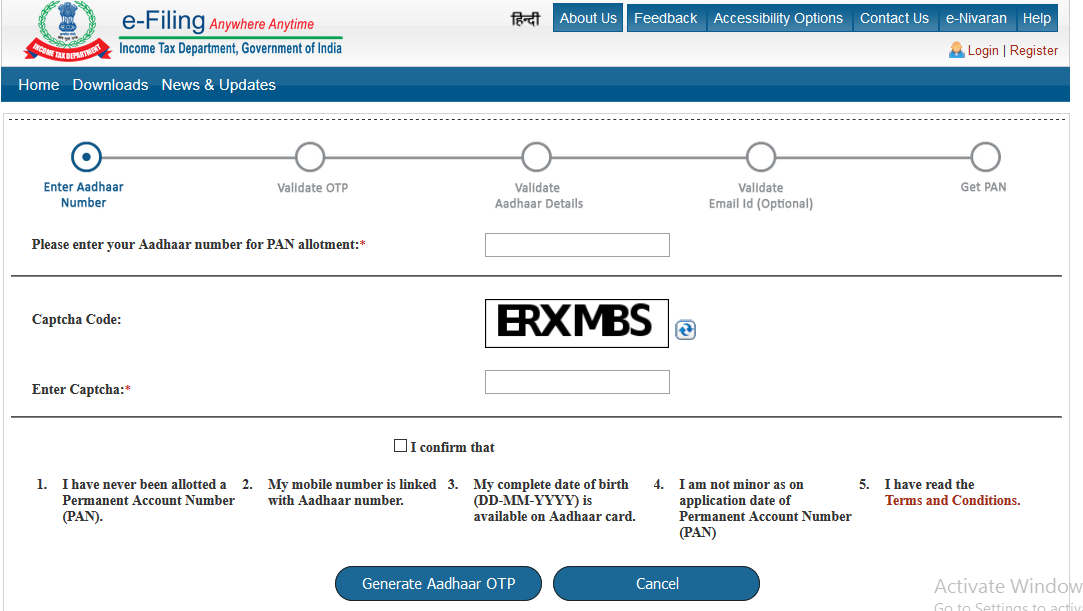

4. Enter your Aadhar number and fill up the captcha code.

5. Then confirm the declaration as given bellow and “Generate Aadhar OTP”.

6. You will receive an OTP on your registered mobile number. You have to submit that OTP and validate the same.

7. Then you have to validate your Aadhar details.

8. You may validate your email id (If registered with UIDAI).

9. After submission, an acknowledgment number will be generated. You must keep that number for future reference.

So, now you get the procedure for the e-PAN application.

Now you have to know how to download e-PAN.

How To Download e-PAN?

Simply, you just follow the following steps:

1. Go to incometaxindiaefiling.gov.in.

2. Click on “Instant PAN through Aadhar”.

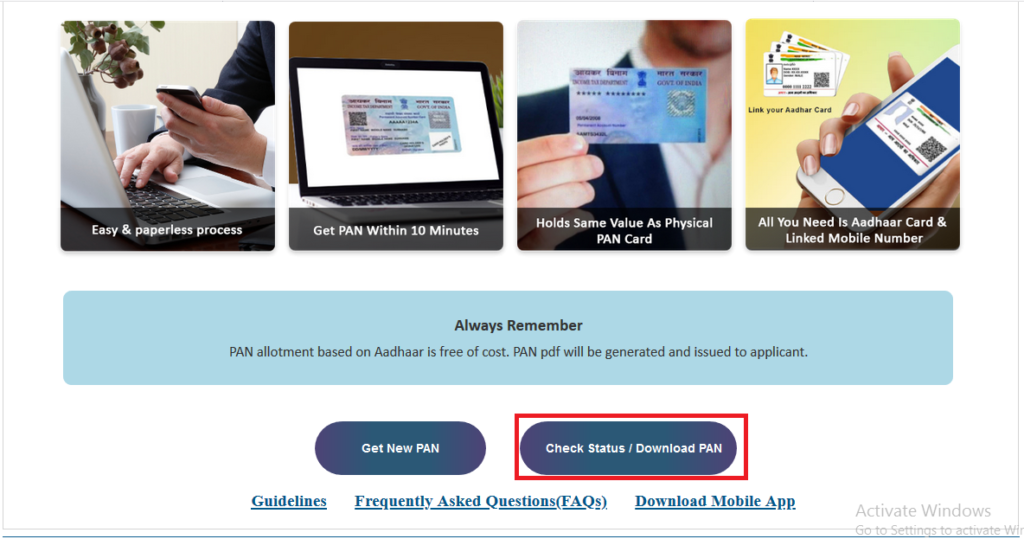

3. Then click – “Check Status/Download PAN”.

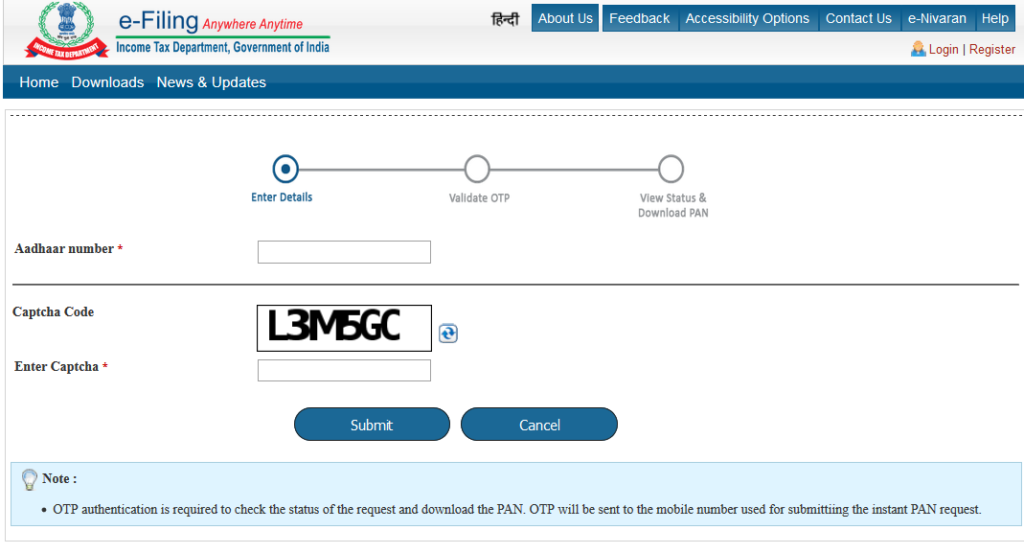

4. Then you have to provide the Aadhar number and the captcha in the required field.

5. Click on the “Submit” button.

6, You will receive an OTP on registered mobile number.

7. Validate that OTP.

8. Then you can check the status of the PAN allotment.

9. If the PAN is allotted, you can download the PAN and can print the PDF format of the e-PAN.

It is very easy. Isn’t it?

Important Points to be remember

The following points are very important for you if you want to apply e-PAN.

- If you already have a PAN then you can’t apply for another PAN. As per provisions of Section 272B(1) of the Income Tax Act, a person having more than one PAN has to pay a penalty of Rs.10,000.

- A foreign citizen can’t apply e-PAN.

- Your Aadhar authentication may be rejected due to the wrong OTP. Please provide the correct OTP. If the problem still exists then please contact UIDAI.

- You can’t make any changes to your existing PAN card through this facility.

After allotment of your PAN, you can get printed physical PAN by submitting the PAN to the following links https://www.onlineservices.nsdl.com/paam/ReprintEPan

https://www.utiitsl.com/UTIITSL_SITE/mainform

I hope this information is very helpful to you. For further information, you may go through the frequently asked question provided by the income tax department. https://www.incometaxindiaefiling.gov.in/e-PAN/index-Faq