You can pay your income tax in both offline and online mode.

However, it is very easy if you choose online mode.

Actually, the procedure of online tax payment system is very user-friendly.

It is really hassle-free.

So, why not you choose the online mode instead of offline mode?

And, the best part is you can pay from your home!

There is no requirement to visit your bank, stand in a queue, wait for your turn, etc.

So, today we will discuss how to pay income tax online.

Contents

- 1 #Step 1: Go To Income Tax e-filing website

- 2 # Step 2: Choose the correct reason for the tax payment.

- 3 # Step 3: Tax Information Network of NSDL.

- 4 #Step 4: Chalan No. 280.

- 5 # Step 5: Choose the mode of Payment.

- 6 # Step 6: Enter your PAN and the Assessment Year.

- 7 # Step 7: Provide your Address details.

- 8 # Step 8: Please Confirm your Information before Proceeding

- 9 #Step 9: Now you are in Net Banking Site.

- 10 # Final Word

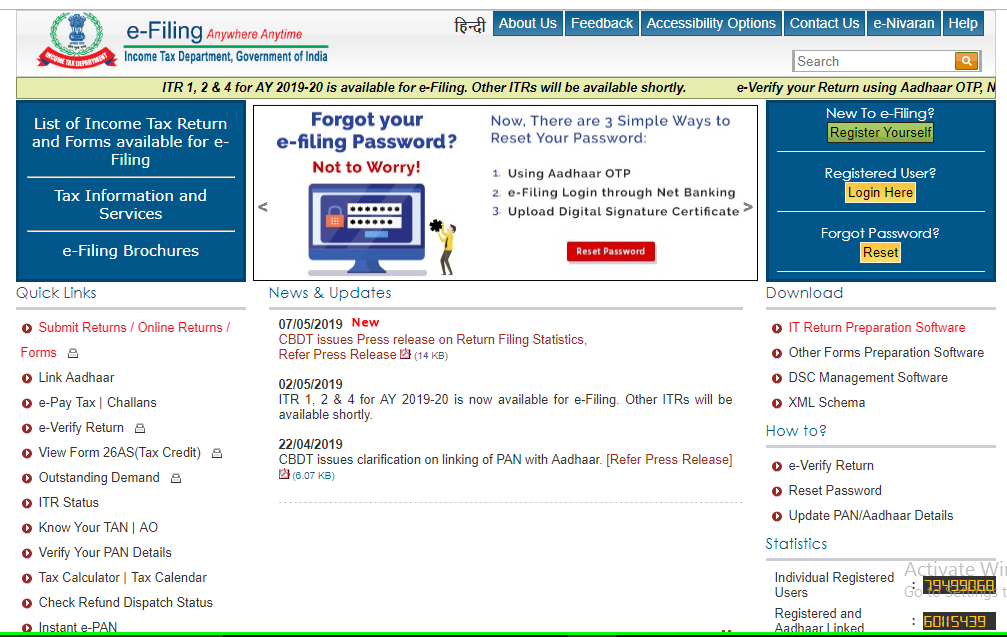

#Step 1: Go To Income Tax e-filing website

This is the very first step.

In order to pay your income tax liability, at first you have to go incometaxindiaefiling.gov.in.

You can see a lot of options are given on the home page of the income tax website.

You have to choose “e-Pay Tax/Challans“.

It is given on the left side of the portal (See the below image). Just click on it.

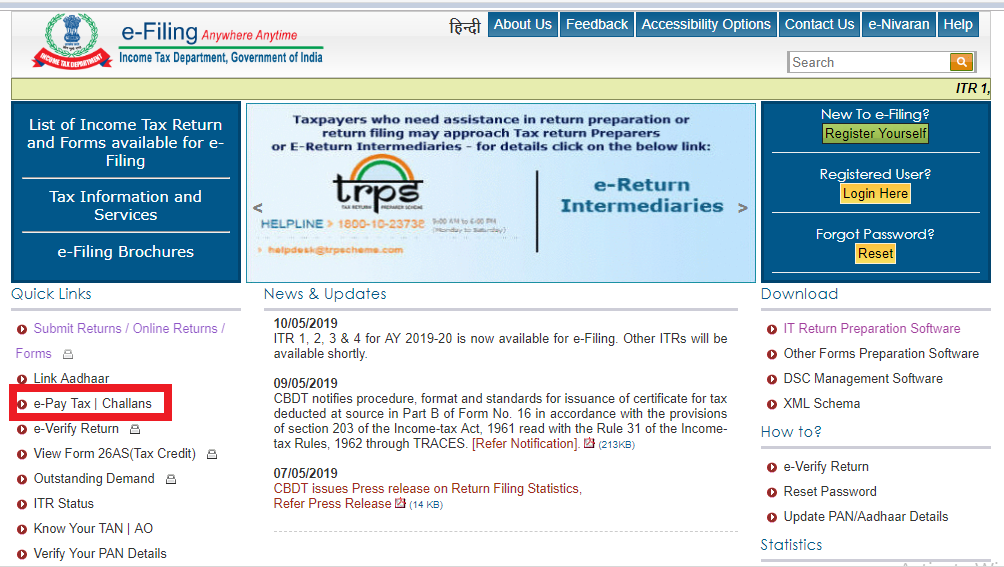

# Step 2: Choose the correct reason for the tax payment.

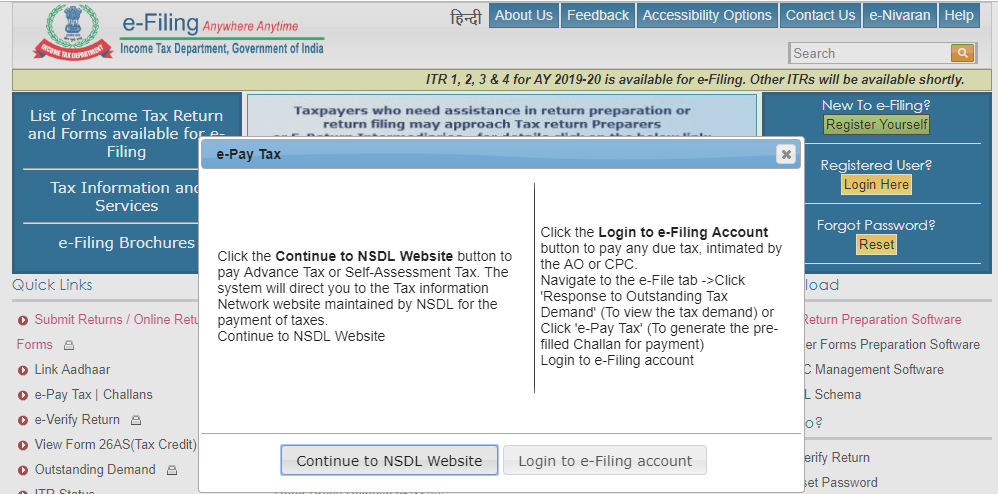

When you click on “e-pay tax/Challans”, a drop-down box will open (Image is given below).

Actually, there are two reasons for the payment of income tax, and they are

- Advance Tax or Self-assessment Tax paid, or

- To pay any due tax liability, intimated by Assessing Officer or CPC.

You have to choose the correct option. See the below image.

In this article, we are discussing how to pay income tax online. For this, you just click on ” continue to NSDL Website“.

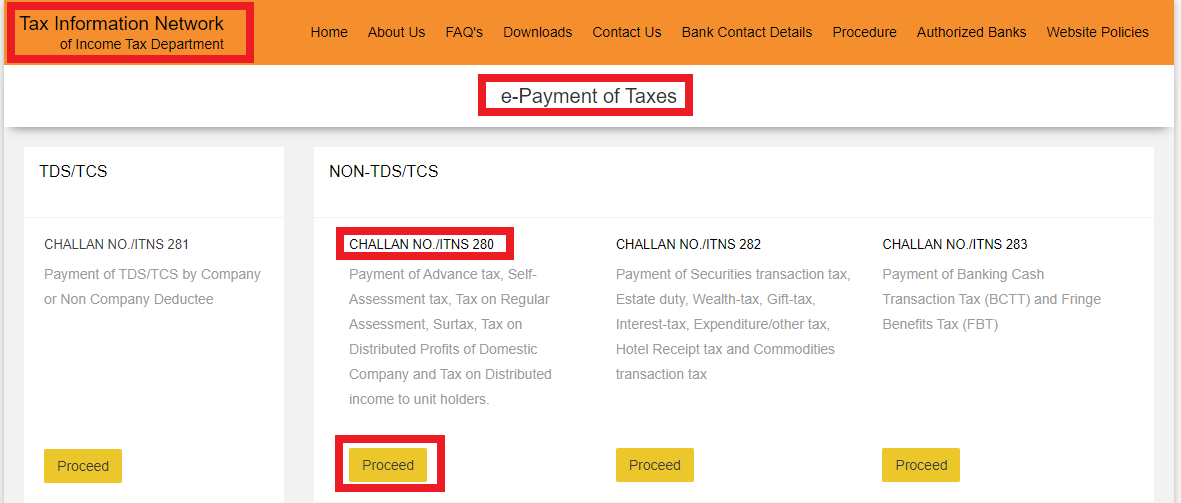

# Step 3: Tax Information Network of NSDL.

After that, a new webpage will open.

And that is known as “Tax information network of Income tax department“.

It is the section for e-payment of tax.

In this section, you can find many challans.

However, you have to choose the correct one and that is “Chalan No. 280”

It is used for the payment of advance tax, self-assessment tax, etc.

Now, click the proceed button for further action.

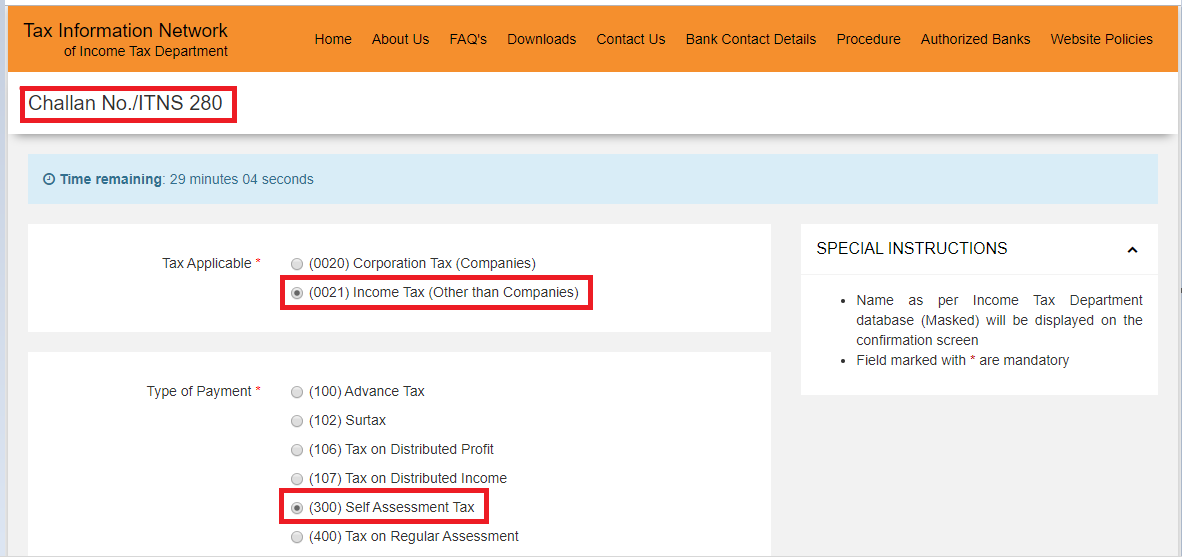

#Step 4: Chalan No. 280.

Now the Chalan no. 280 is open.

You have 30 minutes to complete the entire payment procedure.

At first, you have to choose the applicability of tax.

There are two options:

- (0020) Corporation Tax (Companies), and

- (0021) Income Tax (Other than Companies)

You have to choose as per your requirement. Here our choice is income tax i.e. 0021.

Now, you have to choose the types of payment i.e. advance tax, self-assessment tax, etc.

The code of self-assessment tax is 300, and the code of advance tax is 100.

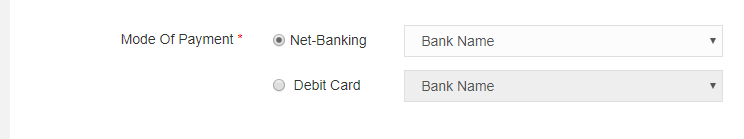

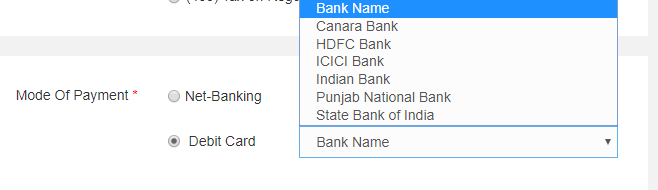

# Step 5: Choose the mode of Payment.

You have to choose the mode of payment you want to use.

There are two types of modes:

- Net Banking, and

- Debit Card.

Remember, you can use only 6 banks for payment to the debit card.

On the other hand, for net banking mode, various banks are given in the option.

Net banking is always a very good option. You have to select it.

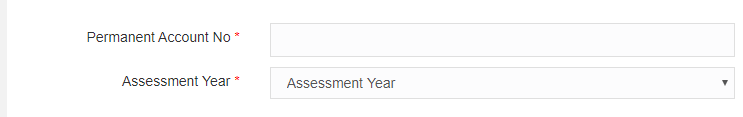

# Step 6: Enter your PAN and the Assessment Year.

Now you have to put your PAN at the given place.

Then you have to select the appropriate assessment year.

These two are really very important information.

Suppose, you put the correct PAN but make a mistake to choose the correct assessment year.

Can you imagine the effect of that mistake?

So, be careful.

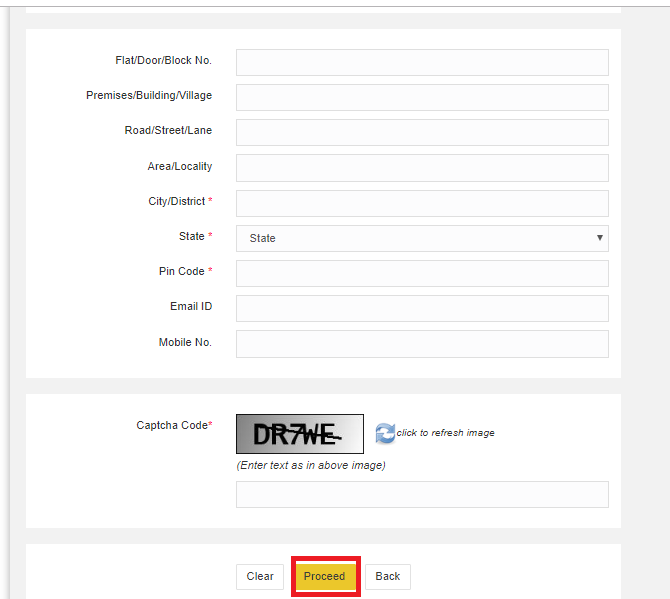

# Step 7: Provide your Address details.

You have to provide your address details in the required field.

All the information are the normal one like flat/door/block number, area/locality, city/district, etc.

Please remember, in all case the red star marks are mandatory. So, please take care of it.

After providing all the information, you have to enter the correct captcha code and then click on the “Proceed” button.

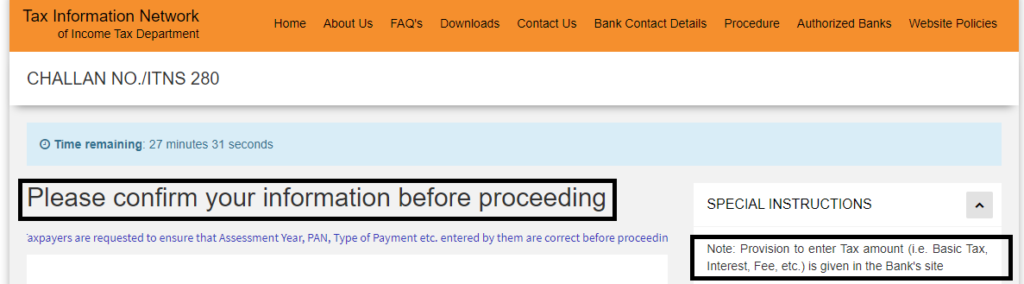

# Step 8: Please Confirm your Information before Proceeding

You have to confirm every information before proceeding. If there is any wrong or incorrect information please rectify it and then proceed.

Now you can ask me where you can show your tax liability.

Actually, you have to give all the information on the bank’s site.

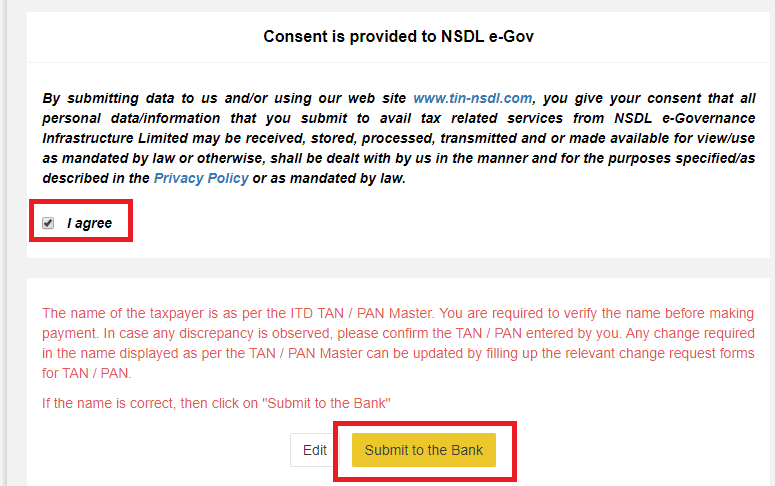

Now, after checking all the information you just click on “I agree“.

And then click on “Submit to the Bank“.

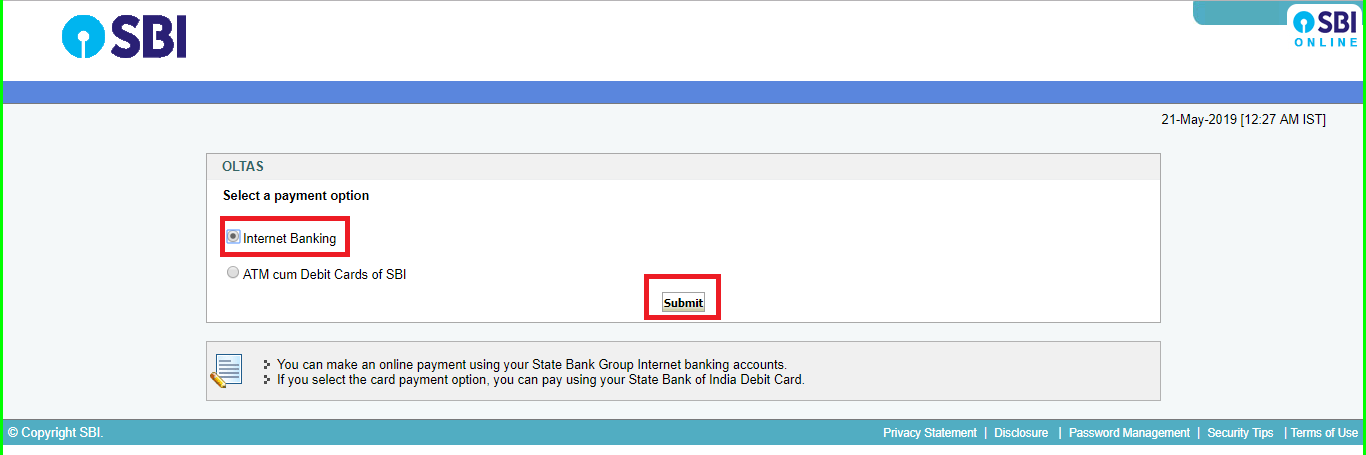

#Step 9: Now you are in Net Banking Site.

Yes!

But before that, you have to re-confirm again that you want to pay your tax by net banking mode.

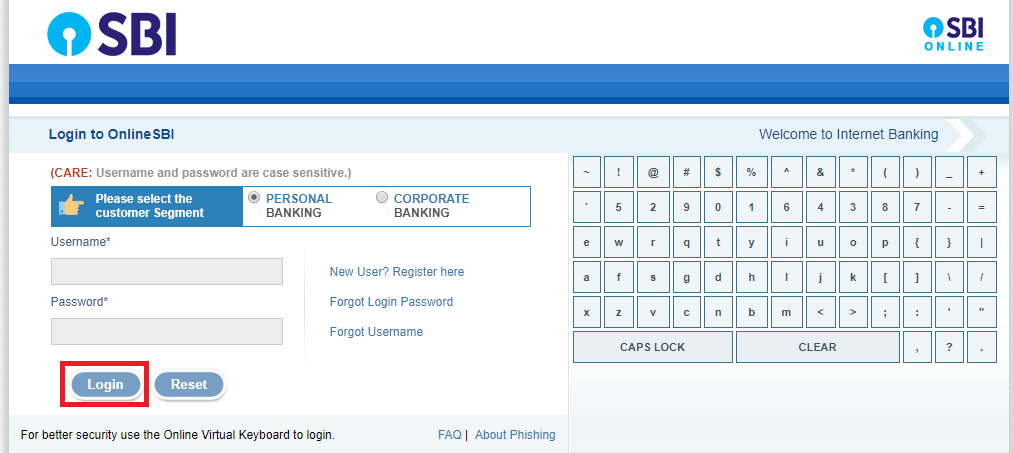

After clicking the “Submit” button, your net banking login page will open.

You have to provide your user name and password in the required area.

And then click on the login button.

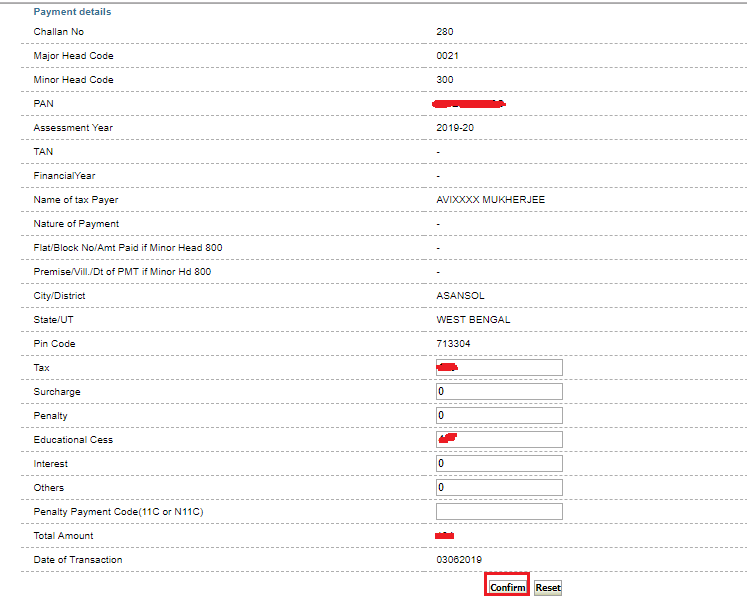

After login in your bank account, you have to declare your tax amount. Then click on the “Confirm” button.

After that, the confirmation page will open. You have to recheck every detail and then click on “Confirm” button again.

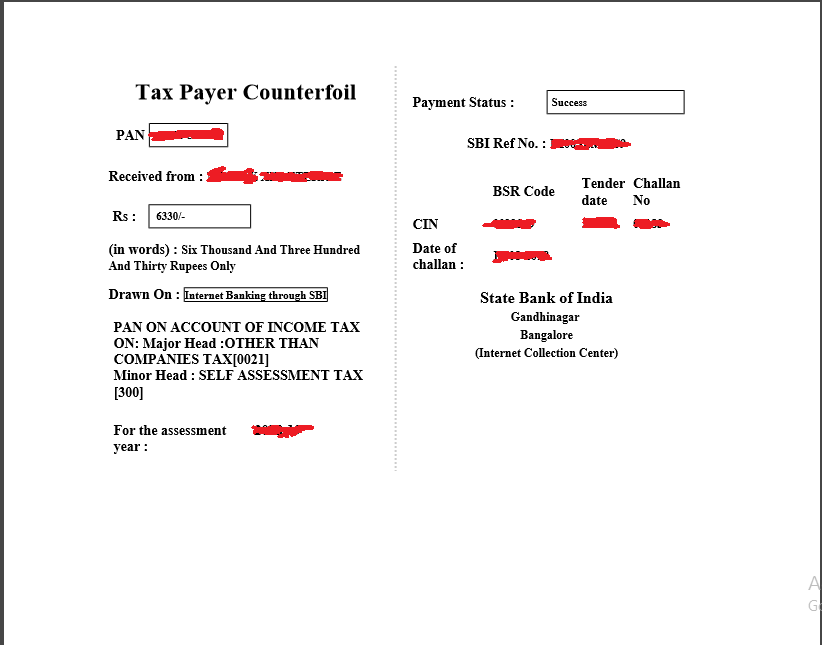

You have done your payment!

The tax payment challan looks like bellow.

Congrats! My Friend.

# Final Word

If you want to pay advance tax, you have to follow the same procedure.

Instead of selecting the self-assessment tax, you have to select advance tax.

All other procedures are same.

Now you can pay your income tax easily.

In case of any problem, please inform me. I am here to serve you, Sir.

For your further knowledge, you can read

How to register and login on the income tax e-filing website?

How to file ITR-1 for the A.Y. 2019-20?

Thank you.

Ta Da.

1 thought on “How To Pay Income Tax Online?”