So, you want to know how to file GSTR 9, right? Today, I have started a new series on “How to File GSTR 9” and this is the first article of this series. And today’s topic is “Basics of GSTR 9”.

I know that every time when there is a question of filing GSTR 9, you have faced so many problems. So many confusions are running here and there in your mind.

Don’t worry my friend. Here, I will provide you each and every step about GSTR 9. I will show you each and every point related to GSTR 9.

So friend, let’s start the discussion.

Contents

What is GSTR 9?

If you are a registered taxpayer then you must have to file the annual return in every financial year. As you already know that there are two types of taxpayers. One is under the regular scheme and the other is under the composition scheme.

If you are a registered person under the regular scheme, then you have to file your annual return in form GSTR 9. You have to provide the details about all of your outward supplies and inward supplies during that financial year. Again, you have to provide the details of all types of taxes related to that supply.

Due Date of GSTR 9

The due date for filing the annual return GSTR 9 is 31st December of the next financial year. For example, if you want to file the GSTR 9 related to FY 2018-19, then the due date is 31st December 2019.

But, there is a lot of changes regarding the due dates and filing procedure. The new due date for filing the GSTR 9 for FY 2018-19 is 30th June 2020. See below

Who Should File GSTR 9

Every Registered person under the regular scheme of GST should file GSTR 9.

In the case of composition taxpayers, the annual return form is GSTR 9A. Again, if you are an e-commerce operator, then you must file your annual return by filing Form GSTR 9B.

However, the following persons are not required to file GSTR 9:

a) Casual Taxable Person,

b) Input Service Distributor,

c) Non-Resident Taxable Person,

d) Persons paying TDS under Section 51 of the CGST Act.

Is there any Late Fee on GSTR 9?

Yes, there is a late fee on GSTR 9. If you fail to file GSTR 9 within due date there is a late fee of Rs 200 per day of delay. In other words, the amount of late fee is Rs 100 under CGST and Rs 100 under SGST.

However, CBIC has notified that there are no late fees in case of the late file of GSTR 9 for the FY 2017-18 and 2018-19. This is only for those taxpayers whose aggregate annual turnover is not more than Rs 2 Crore.

How To File GSTR 9 for FY 2018-19?

Here is the step by step guide for “How To File GSTR 9 for FY 2018-19”.

Step1: Go to GST portal gst.gov.in.

Step 2: Then log in.

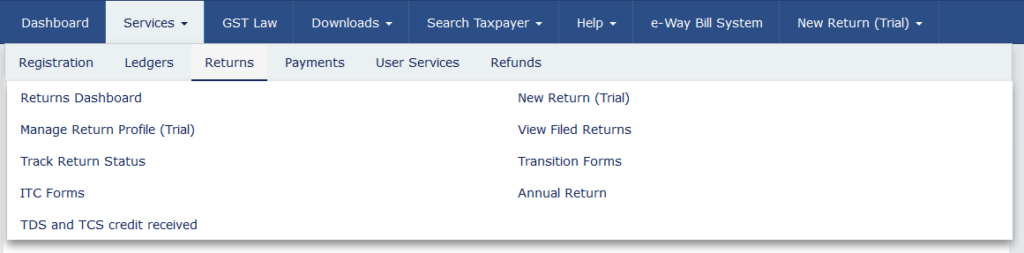

Step 3: Then Click on “Service”. Under that go to “Return” and then click on “Annual Return”.

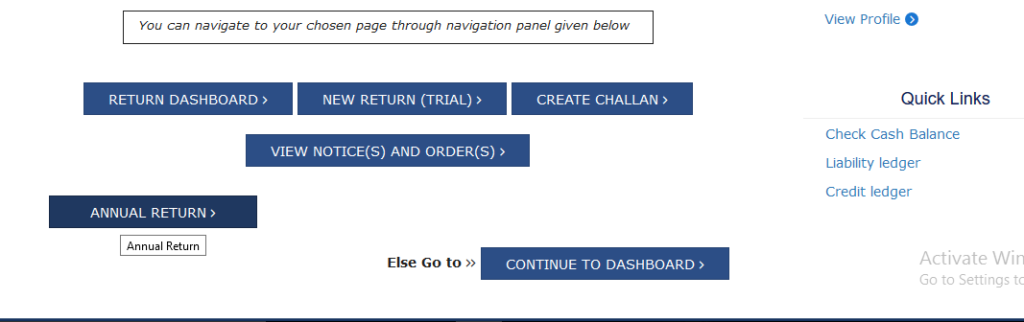

Alternatively, you can select the “Annual Return” button from your dashboard.

Step 4: Then you have to select the financial year as applicable and click on the search button.

Step 5: Click on “Prepare Online” button.

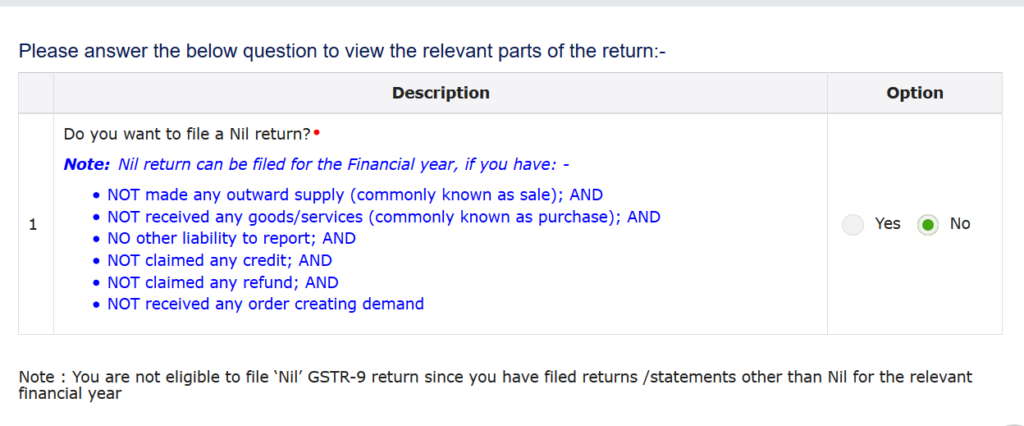

Step 6: After that, a new dialog box will open with two options. One is for “Nil” return and the other is for “Regular” return. You have to choose as per your requirement.

Step 7: If you want to file “Nil” return then choose “Yes”. Otherwise, choose “No”

Step 8: In the case of “No”, you have to provide the required details given in the required tables.

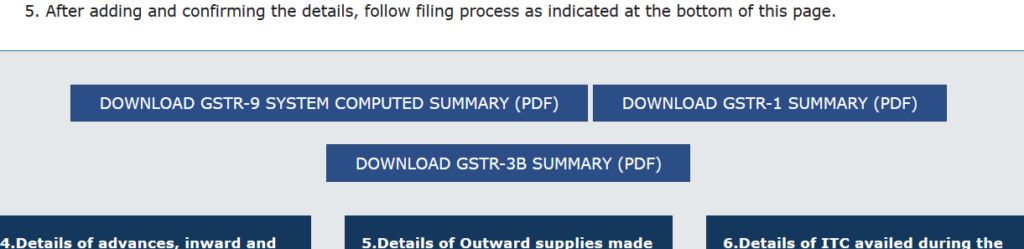

Step 9: Download the system computed summary (PDF) of GSTR 9, GSTR 1, and GSTR 3B.

Step 10: Provide the details in the required tables.

Step 11: Click on the “Preview” button if you want to see the summary in PDF or in excel format.

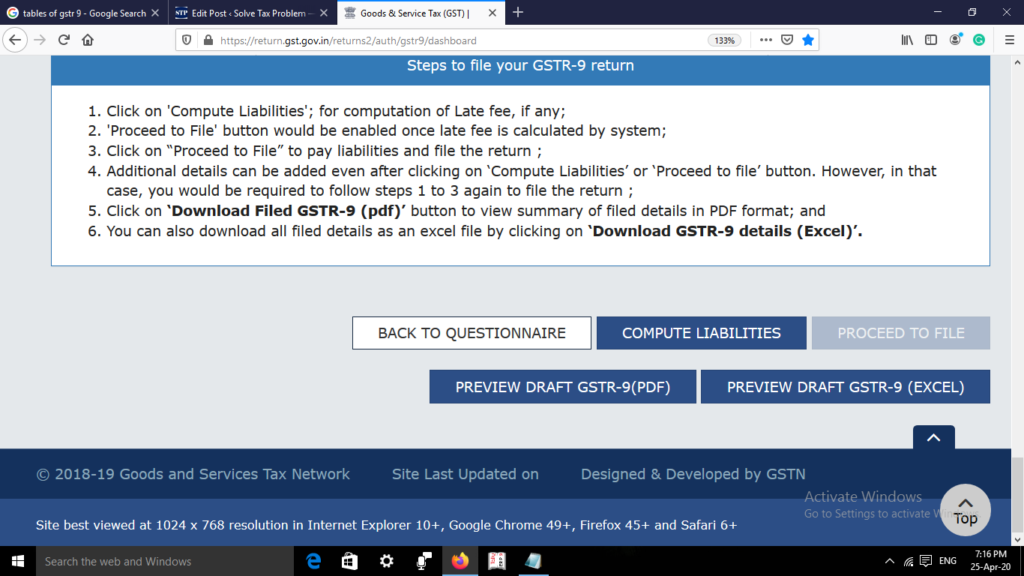

Step 12: Click on “Compute Liabilities: button to see the amount of late fees, if any.

Step 13: “Proceed to File” button appears after the computation of late fees. Click on it.

Step 14: If there are any late fee then paid that late fee.

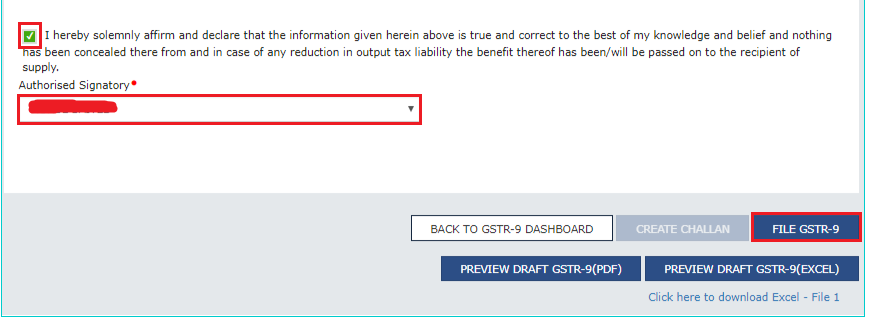

Step 15: Select the declaration box, then select the authorized signatory and then click on the “File GSTR 9” button.

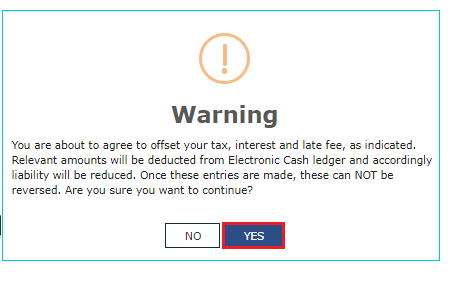

Step 16: An warning dialog box will appear. You have to click the “Yes” button here.

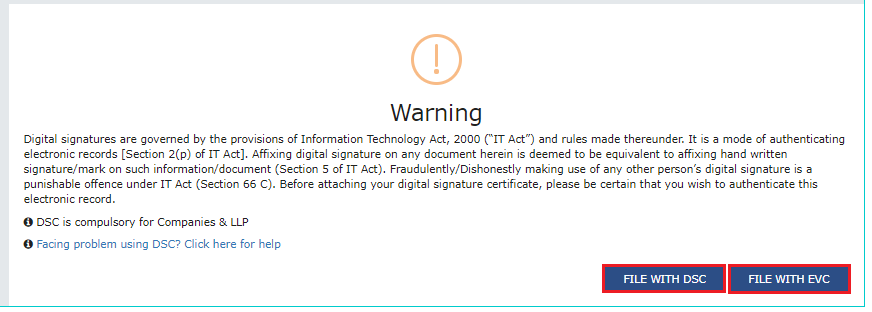

Step 17: Then you can file your GSTR 9 either by DSC or by EVC.

Nil GSTR 9

Nil return can be filed for the FY if you have

- Not made any outward supply (i.e. Sale) for that FY, and

- Not received any goods and/or service (i.e. Purchase) for that FY, and

- No other liability to report, and

- Not claimed any credit, and

- Not claimed any refund, and

- Not received any order creating demand.

If you satisfied all the requirements given above then only you can file the NIL annual return. Otherwise, you have to file GSTR 9 by choosing the option “Other Than Nil Return”.

Tables of GSTR 9

The following are the tables of GSTR 9 which you must have to fill before filing:

- Table 4: Details of Advances, Inward and Outward Supplies made during the financial year on which tax is payable.

- Table 5: Details of Outward supplies made during the financial year on which tax is not payable.

- Table 6: Details of ITC availed during the financial year.

- Table 7: Details of ITC reversed and Ineligible ITC for the financial year.

- Table 8: Other ITC related information.

- Table 9: Details of tax paid as declared in returns filed during the financial year.

- Table 10,11,12 & 13: Details of the previous Financial Year’s transactions reported in the next Financial Year.

- Table 14: Differential tax paid on account of declaration in table no. 10 & 11.

- Table 15: Particulars of Demands and Refunds.

- Table 16: Supplies received from composition taxpayers, deemed supply by job worker and goods sent on approval basis.

- Table 17: HSN wise summary of Outward Supplies.

- Table 18: HSN wise summary of Inward Supplies.

Video Tutorial

Here is the link of a video tutorial about this topic

Final Word

GSTR 9 ones filed can not be revised. So. be careful friends.

In the next part, I will provide you the details of the sales tables of GSTR 9.

I hope this article is helpful.

Please share it with others because sharing is caring.

Ta-Da.