Residential Status of a taxpayer is very much important for income tax purpose. Before the computation of the tax liability of a taxpayer, his/her residential status must be decided for that financial year.

A person may have different residential status in a different year. Again, such person may have different residential status in different countries in the same financial year.

For example, Mr. Avishek is a resident in India for the financial year 2018-19 but he is a non-resident in Bangladesh in that particular financial year.

It may also be noted that ‘Residential Status’ and ‘Citizenship’ both are different. The citizenship of a person does not change in every year. A person may be a citizen of India but maybe not a resident in India. Again, a person who is not a citizen of India (i.e. a foreigner) may be a resident in India for a particular financial year.

Let us discuss it with proper illustrations.

Contents

Residential Status of an Individual [Section 6(1) and 6(6)]

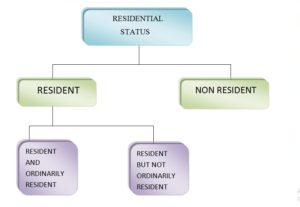

From the above chart, you can easily understand that the residential status of an individual can be divided into two categories, one is RESIDENT and another is NON-RESIDENT.

From the above chart, you can easily understand that the residential status of an individual can be divided into two categories, one is RESIDENT and another is NON-RESIDENT.

Further, there are two types of resident, one is ORDINARILY RESIDENT and another is NOT ORDINARILY RESIDENT.

Resident and Non-Resident

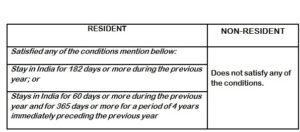

In order to be a ‘RESIDENT’ in India, an individual must satisfy the following conditions:

- He is in India for a period of 182 days or more during the Previous Year [Section 6(1)(a)], or

- He is in India

a) For a period of 60 days or more during the Previous Year, and

b) For 365 days or more during 4 years immediately preceding the relevant previous year [Section 6(1)(c)].

An individual shall be declared as a ‘NON-RESIDENT’ if he does not satisfy both the above-mentioned conditions.

Let us see the following example

1) Mr. Avishek was in India for a period of 200 days during the Previous Year 2018-19. He is a RESIDENT in India for that previous year.

2) Mr. Avishek was in India for a period of 150 days during the P.Y. 2018-19 and from 2014-15 to 2017-18, he was in India for a period of 410 days. Therefore, he was India for more than 60 days during the relevant P.Y. and for 365 days or more during 4 years immediately preceding the P.Y.

Therefore, Mr. Avishek is a RESIDENT in India for that P.Y.

3) In the number (2) example, if he was in India for a period of 59 days (Less than 60 days) during the P.Y. 2018-19 and for a period of 350 (Less than 365 days) days from 2014-15 to 2017-18, he is a NON-RESIDENT in India for the relevant P.Y. 2018-19.

Exceptions of Section 6(1)(c)

In the following cases, the provisions of Section 6(1)(c) will not be applicable

- In case of an individual, who is a citizen of India, leaves India for the purpose of employment in any previous year.

- In case of an individual, who is a citizen of India, leaves India as a member of the crew of an Indian ship in any previous year.

- Similarly, in case of an individual, who is an Indian citizen, leaves India as a crew member of a foreign-bound ship in any previous year.

- In case of an individual, who is an Indian citizen or a person of Indian origin, normally resides outside India and came to India for visit purpose.

In the above-mentioned cases, such individual shall be a RESIDENT in India if he stays in India for a period of 182 days or more in a previous year.

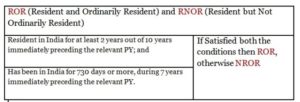

Ordinarily Resident and Not Ordinarily Resident [Section 6(6)]

A resident individual shall be treated as ORDINARILY RESIDENT in India if he satisfied both the following conditions [Section 6(6)]

A resident individual shall be treated as ORDINARILY RESIDENT in India if he satisfied both the following conditions [Section 6(6)]

- He has been RESIDENT in India for at least 2 years out of 10 previous years immediately preceding the relevant previous year, and

- He has been in India for 730 days or more, during 7 previous years immediately preceding the relevant previous year.

A resident individual shall be treated as NOT ORDINARILY RESIDENT in India if he does not satisfy any or both the above-mentioned conditions.

How to count the number of days?

It may also happen that the time of arrival and departure are not known or not clearly known. There is no such information about them.

In that case, the day of arrival and the day of departure both will be included at the time of determination of residential status.

On the other hand, if there is information about the time of arrival and departure then both shall be considered. In this case, 24 hours or more shall be treated as one day.

Residential Status of a HUF [Section 6(2)]

A HUF shall be treated as RESIDENT in India if its business is controlled and managed WHOLLY or PARTLY in India.

On the other hand, a HUF shall be treated as NON-RESIDENT if its business is controlled and managed WHOLLY outside India.

Ordinarily Resident and Not Ordinarily Resident of HUF

If the KARTA of HUF satisfied the conditions mentioned in Section 6(6), the HUF shall be an ORDINARILY RESIDENT in India.

If the KARTA does not satisfy any one or both the conditions mentioned in Section 6(6), the HUF shall be treated as NOT ORDINARILY RESIDENT in India.

Importance of KARTA’s Residential Status

In case the HUF is a resident or not, the residential status of Karta is not considered.

However, for the purpose of determination of Ordinarily/Not Ordinarily Resident of HUF, the status of Karta for the preceding years is important.

It may happen that the Karta is a Resident but the status of HUF is Non-resident and vice-versa.

For example, Mr. Avishek is a Karta of a HUF. In the previous year 2018-19, the status of HUF is resident but Mr. Avishek is a non-resident. However, he satisfied both the conditions mentioned in Section 6(6). In that case, the status of the HUF is ‘Resident and Ordinarily Resident’.

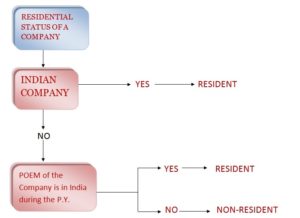

Residential Status of a Company [Section 6(3)]

A Company is a RESIDENT in India in any previous year, if

A Company is a RESIDENT in India in any previous year, if

- Such Company is an INDIAN COMPANY, Or

- Its Place of Effective Management (POEM), in that year, is in India.

Here, POEM means a place where key management and commercial decisions that are necessary for the conduct of the business of any entity as a whole are, in substance made.

Residential Status of Firm/AOP/BOI [Section 6(4)]

A firm, AOP etc shall be treated as RESIDENT in India if the business is controlled and managed WHOLLY or PARTLY in India.

On the other hand, a firm, AOP etc shall be treated as NON-RESIDENT in India if the business is controlled and managed WHOLLY outside India.

Incidence of tax [Section 5]

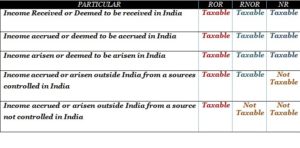

The incidence of tax of any person depends on its residential status. It is also known as ‘Scope of Total Income’. In order to understand the scope of total income, the following situations are considered

- Income Received or Deemed to be received in India

- Income accrued or deemed to be accrued in India

- Income arose or deemed to arise in India

- Income accrued or arisen outside India from sources controlled in India

- Income accrued or arisen outside India from a source not controlled in India

Now see the following chart to understand it

From the above charts, it is very clear that

From the above charts, it is very clear that

- ROR is always taxable in all the situations.

- RNOR is not taxable for income accrued or arisen outside India if the source of income is not controlled from India.

- NR is not taxable if the income accrued or arisen outside India.

Here ROR= Resident and Ordinarily Resident, RNOR= Resident but Not Ordinarily Resident and NR= Non-Resident.

It may also be noted that for a Company or a Firm/AOP etc can’t be an ordinarily resident or a not ordinarily resident. They can be only resident or non-resident.

Questions and Answers Zone

Q1. Can a person be a Resident in more than one country?

Ans: Yes. A person can be a Resident in more than one country in the same financial year. A person can be treated as a resident in India in accordance with the provisions of Income Tax Act, 1961. Similarly, he may be a resident in any other country in accordance with that country’s Income Tax Act.

However, if a person never left India, he can not be a resident in any other country.

Q2. Mr. Avishek left India for employment purpose. He stays in India for 75 days. He never left India before. What will be his residential status?

Ans: As he left India for the purpose of employment, the provisions of section 6(1)(c) will not be applicable. Only the provisions of section 6(1)(a) will be applicable. He stays in India for less than 182 days. Hence, He is a Non-Resident.

In case he left India for any other purpose, the answer will be different. In that case, both the sections will be applicable. Mr. Avishek will be treated as Resident because he fulfills the conditions given u/s 6(1)(c).

Again, he never left India in the past. So, he fulfills both the conditions u/s 6(6). Hence, he will be treated as ROR.

Q3. Mr. Avishek is a Karta of a HUF. He is a Resident in India for the PY. Therefore, the HUF is also a resident. Is the statement true?

Ans: NO. The statement is incorrect.

A HUF is treated as a Resident only when the business is wholly or partly controlled in India. If it is wholly controlled outside India then it will be a Non-Resident. Therefore, the status of Karta is irrelevant.

Whether the HUF is an ordinarily resident or non-ordinarily resident that will depend on the status of Karta. If the Karta satisfies both the conditions mentioned in section 6(6), the HUF is also an ordinarily resident. If he does not satisfy both the conditions then the HUF will be a Non-Ordinarily Resident

Finally if you like this article and think it will be helpful to others then please share it. Your share buttons are given below.