It may happen that you just start your return filling procedure and at the right moment you forget user id and password of GST portal.

Your all data are ready, all accounting entries are finished but you can’t move further without that valid information I.e., user id and password.

So, what is your next step? What can you do for that?

Don’t worry my friend. It is a very common matter. You are not alone. I have also made this kind of mistake.

Today I want to file one GSTR 3B i.e. monthly return of my client but I forgot user id and password.

Actually, it was totally my mistake. Every time after GST registration I note down all user id and password on my notebook. Somehow I forgot in this case. But I recover the user id and through this, I have changed the password also.

So, I just want to share my experience with you.

Contents

How to recover User Id

If you forget your username, you can easily recover it through the following steps:

- Go to GST portal www.gst.gov.in

- Click on login button.

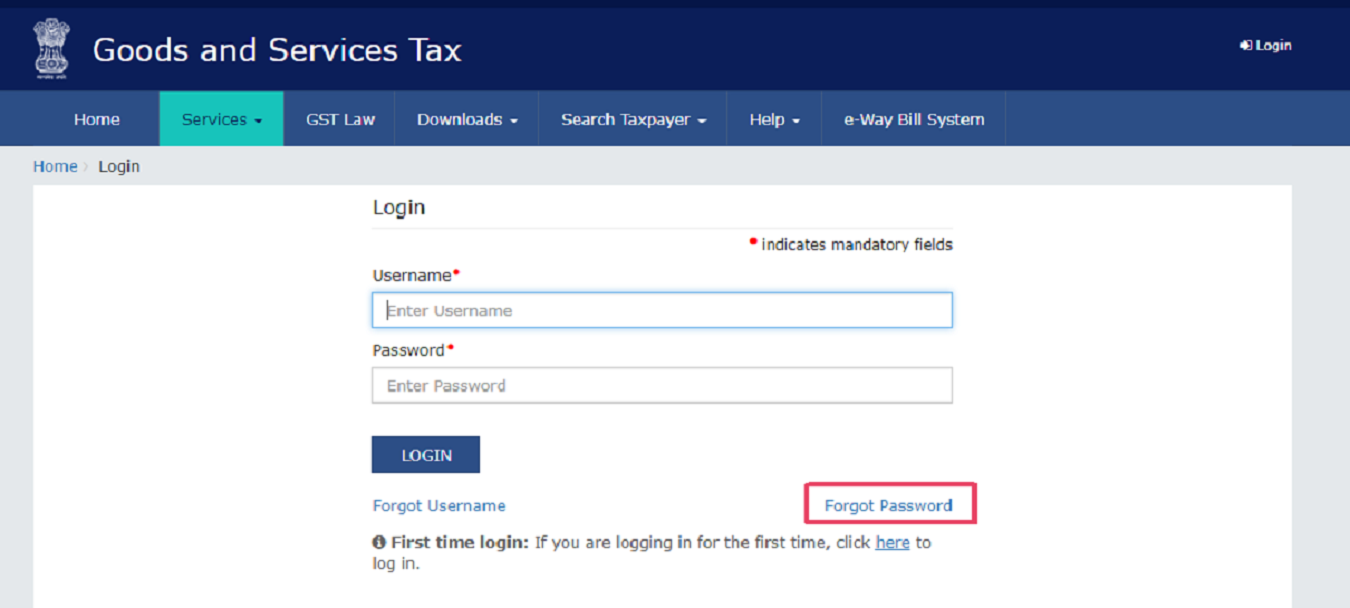

- You can find “Forgot Username” button in the bottom of the page. (Highlighted with red mark)

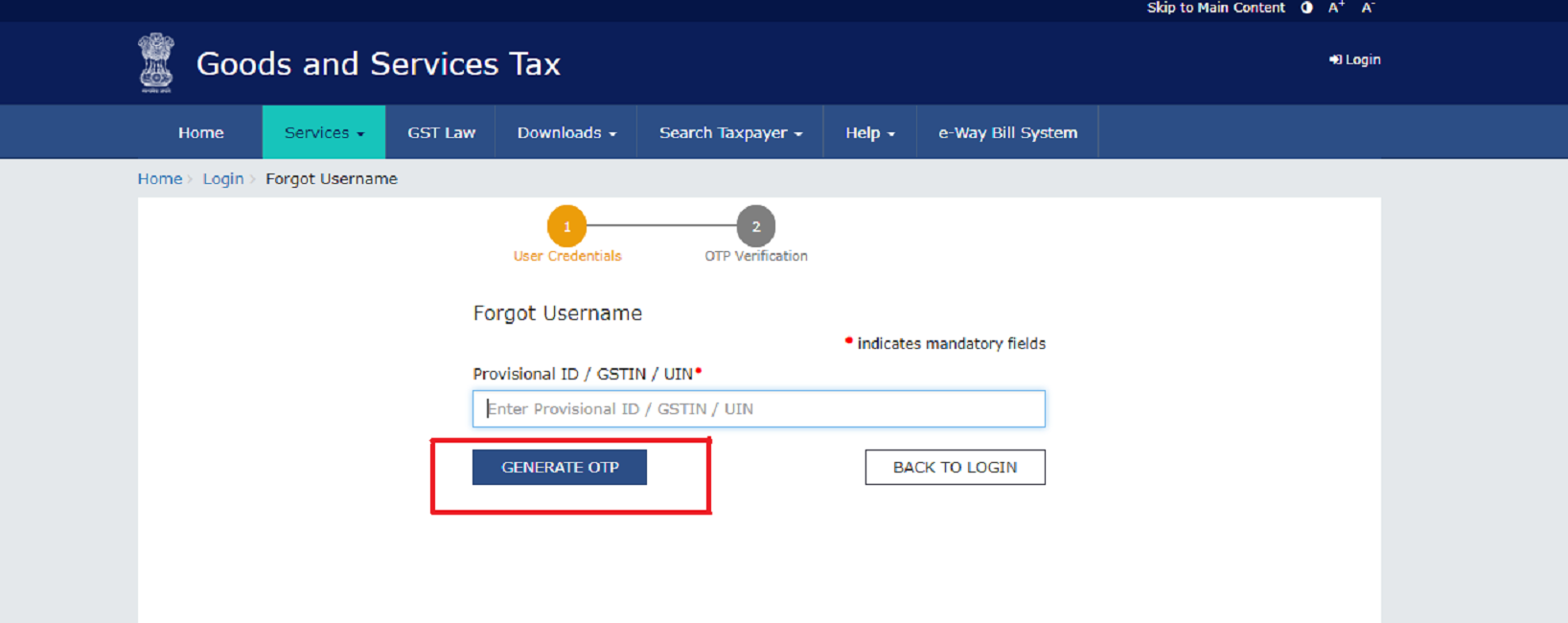

- The next page will open. In that page, you will submit your GST Registration Number (GSTIN) or any Provisional ID or UIN. Then click on “Generate OTP” button.

- You will receive an OTP in your registered mobile number and on your registered email ID.

- Put your OTP on the given place and click on the submit button

- You will receive your USER ID in your email.

It is so simple, isn’t it? And you can very easily remember this procedure.

How to reset new Password

If you forgot your password, you can easily recover it through the following steps:

- Go to GST portal www.gst.gov.in

- Click on login button.

- You can find “Forget Password” button in the bottom of the page. (Highlighted with red mark).

- The next page will open. In that page, you will submit your username. Then click on “Generate OTP” button.

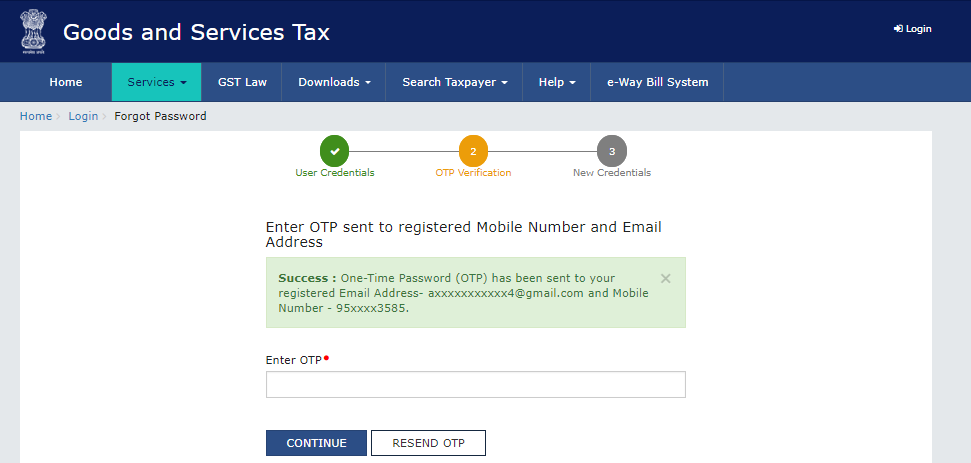

- You will receive an OTP in your registered email id and registered mobile number both.

- Put your OTP in the given place and click on submit button.

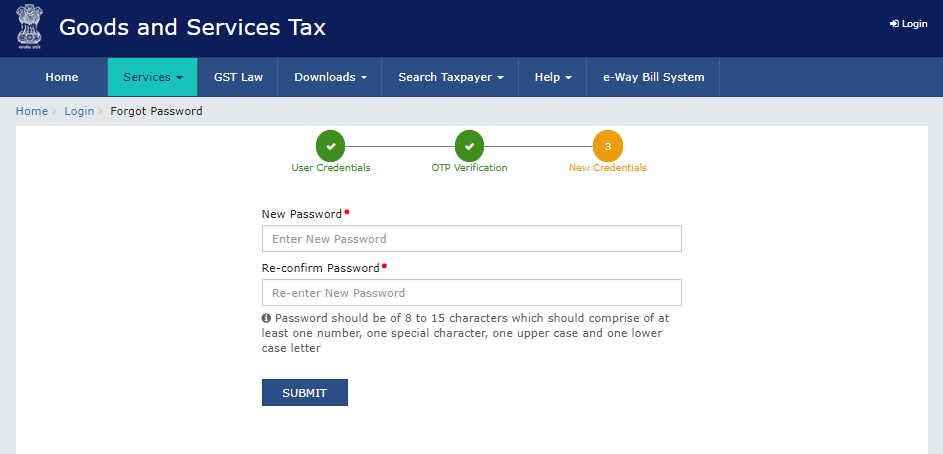

- Enter “New Password” in the given box. Then reenter the same password. The password should be of 8 to 15 characters which should comprise of at least one number, one special character, one upper case, and one lower case letter. Then click on the submit button.

- You will receive your new password in your registered email id.

Now, you are able to enter on your GST portal. There will be no problem to complete your legal works.

Accountant/Consultant used his Mobile number and email id

From the above-mentioned procedures, you can understand that mobile number and email id both play an important role in this matter.

In my “12 important things you must know before GST registration”, I have already told you about the importance of mobile number and email id. At the time of registration, mobile number and e-mail id are required. It may happen that the CA/CMA or other practitioners may use their own mobile number and e-mail id. In that case, all the required OTP will come in their mobile number. If you want to change your consultant then you will face difficulty to get user id and password.

You can contact and request to the proper officer to change the mobile number and email id but it will be time-consuming. So you have to careful in this matter.

The format of Application Letter to the Concerned Officer

To

The Officer

Goods & Service Tax

[Address of the Office]Sub: Application for change of user id and password

Respected Sir,

This is to inform you that I, [Name of the proprietor/partner, etc.], Prop/partner of [Trade Name of the Business i.e. M/S XYZ], could not update my filling of GST, because the lawyer who had processed my registration mentioning his email id and mobile number is not responding me. Please provide user id and password in my new email id [xyz@gmail.com] and mobile no [1234567890] and keep it in the record as registered for further processing.

I am also authorizing [The name of New Authorized Person] as new authorized Signatory of M/S XYZ.

Please help me as soon as possible and obliged me thereby.

Thanking You,

Yours Sincerely,

[Name of the PROPRIETOR/PARTNER]

GSTIN-

DATE-

You can download the above letter from Request letter for change user id and password

Details are given in the below video tutorial section.

You have user-id and password but want to change email id and mobile number

In this case, you have to follow the following steps:

- Login to GST portal.

- Click on “Service” button.

- Under the Registration section, click on “Amendment of Registration (Non-core fields)

- Then change the phone number and email id of the proprietor.

- An OTP will send to your new mobile number and email id.

- Provide that OTP and save that section.

- After that, you should submit the amendment request.

- EVC will send to your new mobile number and email id.

- For details, watch the Videos given below.

Video Tutorial

You can watch these videos to know further

Part 1

Part 2

I always advise my client to give their mobile number at the time of registration. Yes, I use my e-mail id with proper consent of my client. If they want to go to another consultant then they can change the password very easily because of their mobile number (I also provide them the password because password always belongs to the client and it is not my property).

So, my friend, that’s all. You are now able to change your password if required. As you can see it is not tough work. You can easily complete this work within time. Don’t forget to share your experience if you face this type of problem in the future.

It’s really easy and nice way to make the practioners and dealers to retrive the forgotten password for continuing the further filling process without delay and simultaneouly to save the penalty expected to be levied on .

Kindly tell me how can I retrieve my Gst user Id and password if my mobile number is registered on portal but Consultant’s email ID is registered and he is not wolling to share his email id password on user id sent on his email.

Hello, Sir.

First of all, I am very sorry because some professionals (One of us) are doing this bad practice.

Now come to the main point. As per the system, your user id will be given only on your e-mail id. So, it is impossible to get that from your consultant’s e-mail.

Please go to your jurisdictional office and apply him for a fress user id and password in your email id and mobile number.

Just go and tell him your problem. Don’t tell him the name of that consultant. May be they are friend. After that again contact me. I will help you. Thanks